Your location:Home >Automotive News >

Time:2022-06-23 17:26:45Source:

On the evening of June 22, CATL disclosed the results of the fixed increase: the issue price is 410.00 yuan per share, the issue price is 120.71% of the issue reserve price, and the total amount of funds raised is 44,999,999,770.00 yuan, after deducting various issuance expenses (excluding value-added tax) RMB 129,886,562.36 yuan, the actual net amount of funds raised is RMB 44,870,113,207.64 yuan.

According to the announcement, a total of 42 investors participated in the subscription offer, of which the highest bid was CSOP Asset Management Co., Ltd. with a subscription price of 462 yuan/share; the lowest bid was Nord Fund Management Co., Ltd., with a subscription price of 339.89 yuan/share The price difference between the two amounts to 122 yuan per share.

In the end, 22 investors were allocated.The investor with the most allocation was Guotai Junan Securities Co., Ltd., which placed 11.3754 million shares with an allocation amount of 4.664 billion yuan; the three investors with the least allocation were Golden Eagle Fund Management Co., Ltd., Taikang Asset Juxin Stock Special Pension Products, Everbright Sun Life Assets - Ningde Capital - CNCB Wealth Management Juyi No. 25 equity asset management products, 2,926,800 shares were placed respectively, with a placing amount of about 1.2 billion yuan.

CITIC Construction Investment, the sole sponsor, stated that the subscription amount exceeded twice the size of the raised funds, which was the largest subscription multiple for projects of the same type. The largest refinancing project by way of inquiry and fully subscribed in cash.The issue price reached 92.80% of the closing price on the trading day before the subscription quotation date. This ratio is the highest level of the new energyindustry’s inquiry-based stock fixed increase project since 2022, and itis also the highest level of the new energy industry’s inquiry-based stock fixed increase project in recent years. one.

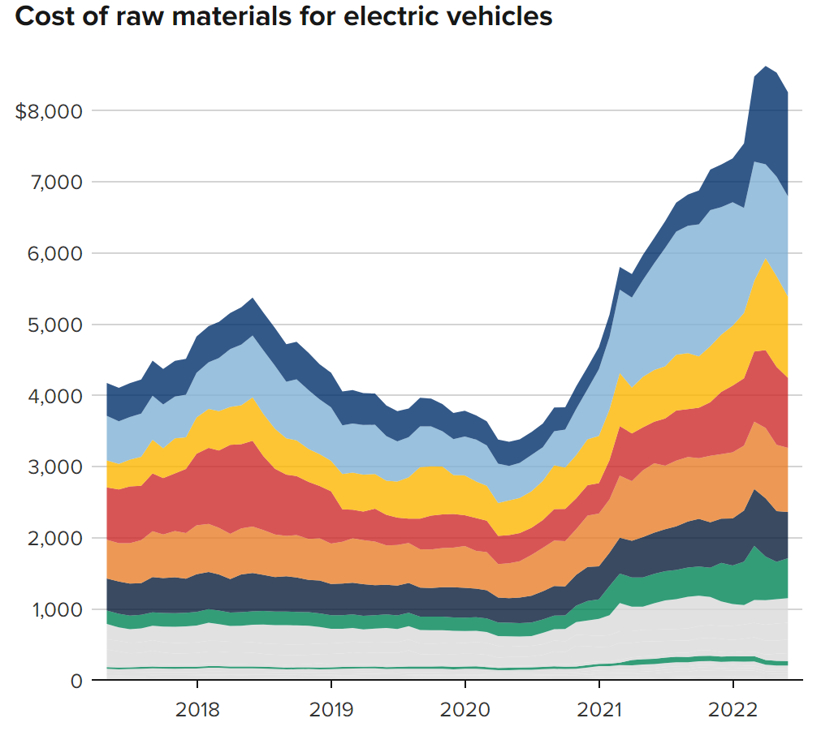

The fixed increase investment project includes 4 production bases, namely the Fuding Times lithium-ion battery production base project, the first phase of the Guangdong Ruiqing era lithium-ion battery production project, and the Jiangsu Times Power and energy storage lithium-ion battery R&D and production project ( Phase 4), Ningde Jiaocheng Times Lithium-ion Power Battery Production Base Project (Cheliwan Project), using raised funds of 15.2 billion yuan, 11.7 billion yuan, 6.5 billion yuan, and 4.6 billion yuan respectively, and another 7 billion yuan was invested in Ningde Times New Energy Advanced Technology R&D and Application Project.

The annual report shows that at the end of 2021, the company's monetary capital was 89.072 billion yuan, and the net operating cash flow was 42.908 billion yuan.Previous equity financing includes IPO in 2018 and fixed increase in 2020, raising 5.33 billion yuan and 19.6 billion yuan respectively.CATL replied to the Shenzhen Stock Exchange that the first equity financing had been used up; as of the end of September 2021, 79.38% of the second had been used.

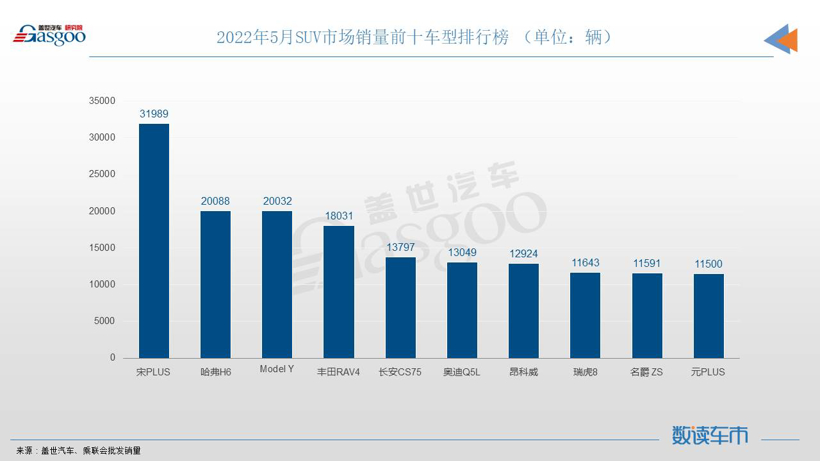

Second-tier power battery factories are also stepping up their expansion, putting some pressure on the market share of CATL.According to data from China Power Battery Industry Innovation Alliance, in the first five months of this year, the market share of CATL’s power batteries was 47.05%, down from 52.1% last year. They were 22.58% and 8.09% respectively.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-23 17:13:10

2022-06-23 17:13:11

2022-06-23 17:13:12

Hot spotsranking

Wonderfularticles

2022-06-23 17:13:16

2022-06-23 17:13:17

2022-06-23 17:05:52

2022-06-23 17:05:53

2022-06-23 17:05:54

Popularrecommendations