Your location:Home >Automotive News >

Time:2022-06-28 16:37:02Source:

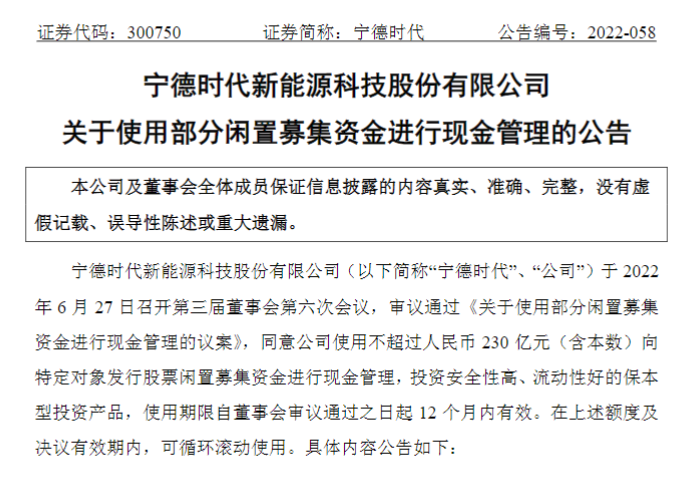

On the evening of June 27, CATL issued the "Announcement on Using Part of Idle Raised Funds for Cash Management".The announcement shows that the board of directors of CATL agreed that the company will use no more than RMB 23 billion (including the capital) to issue stocks to specific objects to raise funds for cash management, and invest in capital-guaranteed investment products with high security and good liquidity.

CATL intends to use part of the idle raised funds for cash management; Image source: screenshot of the announcement

According to the announcement, the funds for cash management this time came from the nearly 45 billion fixed increase completed by CATL last week.

On June 22, Ningde Times disclosed the results of the fixed increase. Ningde Times issued 109,756,097 shares to specific objects, with a face value of RMB 1.00 per share and an issue price of RMB 410 per share. The total amount of funds raised was RMB 44,999,999,800, after deducting various issuance expenses. After 129,886,600 yuan (excluding value-added tax), the actual net amount of funds raised was 44,870,113,200 yuan.

According to the "Ningde TimesNew EnergyTechnology Co., Ltd. Issuance of Stocks to Specific Objects (Revised Draft)", as well as the total amount of funds raised and issuance expenses, after deducting the issuance expenses, CATL will invest in Fuding Times Lithium Ion Battery Production Base Project, Guangdong Ruiqing Times Lithium Ion Battery Production Project Phase I, Jiangsu Times Power and Energy Storage Lithium Ion Battery R&D and Production Project (Fourth Phase), Ningde Jiaocheng Times Lithium Ion Power Battery Production Base Project (Cheliwan Project), Ningde Times New Energy Advanced Technology R&D and Application Project.

Ningde Times stated that the reason why some of the idle raised funds are used for cash management is to improve the efficiency of the company's capital use, increase capital income without affecting the construction of raised funds investment projects and the normal operation of the company, and obtain more for the company and its shareholders. s return.According to the company's current use of funds, the construction progress of raised funds for investment projects, and considering maintaining sufficient liquidity, CATL intends to use no more than RMB 23 billion (including this amount) to issue stocks to specific objects and use idle raised funds for cash management. The time limit shall be effective within 12 months from the date of consideration and approval of this proposal.

The announcement also pointed out that CATL will strictly control risks in accordance with relevant regulations and conduct strict evaluation of investment products. Investment products with idle raised funds must meet: 1. High security, meet the requirements for capital preservation, and the product issuer can provide capital preservation commitments; 2. Liquidity It has good performance and does not affect the normal progress of fundraising and investment projects.The products to be invested include but are not limited to principal-guaranteed wealth management products, structured deposits, time deposits or large-denomination certificates of deposit, etc., with a holding period of not more than 12 months.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-28 16:35:19

2022-06-28 16:34:01

Hot spotsranking

Wonderfularticles

2022-06-28 16:16:06

2022-06-27 13:08:54

2022-06-27 13:08:00

2022-06-27 13:07:09

2022-06-27 13:03:42

Popularrecommendations