Your location:Home >Automotive News >

Time:2022-06-22 17:06:20Source:

In the past two years, with the rapid increase in the penetration rate of smartelectric vehiclesand the continuous increase in policies, automotive braking systems have begun to rapidly evolve towards wire-based control.We have seen that OEMs such as BYD, Great Wall, Geely, and Jidu have increased their attention to this field, and international component giants such as Bosch, Continental, and ZF have gradually increased their investment. Bethel,Lianchuang Automotive Electronics,A number of domestic brands such as Yingchuanghuizhi, Jingweida, Gelubo, Li Krypton Technology, and Haizhibo have also begun to exert their efforts, and the entire BBW circuit has been upgraded, which has aroused the pursuit of capital markets.Let's take a look at the current development of this field.

Market status: The market penetration rate is low, but it has entered the tuyere period

The brake-by-wire system is also known as the electronically controlled braking system.In fact, brake-by-wire is not a new concept. Before the advent of autonomous driving, it has already been matched in traditional cars.In 1997, the ECB developed by ADVICS was applied to Toyota Prius; in 2001, the SBC developed by Bosch was applied to the Mercedes-Benz CLS sports car, SL sports car and E-class; in 2009, the SBC developed by ZF TRW was applied to Ford's Fusion and Mercury Milan.However, the technological development of BBW products in this period was at an early stage, and the cost was relatively high, and the market volume was relatively small.

After a lapse of more than ten years, with the increase in the penetration rate of smart electric vehicles, the technology has gradually evolved from the original "optional" to "standard".There are two main reasons for this:

1. In new energy vehicles, the brake-by-wire system replaces vacuum assistance with electronic assistance, which solves the problem of lack of stable vacuum sources for new energy vehicles.In addition, the brake-by-wire can also realize energy recovery, increase the cruising range, and alleviate theurgent need fornew energy vehicles .

2. The realization of L3 and higher-level autonomous driving is inseparable from the rapid response and precise execution of the executive agency, so as to achieve a high degree of coordination with the upper-level perception and decision-making.The brake-by-wire is the most critical part of the "control execution layer" of autonomous vehicles, and it is the cornerstone of execution for higher-level autonomous driving.

Therefore, the brake-by-wire system is an inevitable choice for the electrification and intelligence of automobiles.However, from the current stage, BBW is still in the early stage of development, the current penetration rate is low (about 3%), only a small number of models are equipped, and the configuration rate ofnew energyvehicles is relatively high.With the gradual penetration of new energy vehicles and L3 and above intelligent driving vehicles, the brake-by-wire market is expected to explode.Wuhu Bethel, a domestic provider of drive-by-wire chassis technology, said in an exchange with Gasgoo that the drive-by-wire is currently in the early stage of commercialization, and the market will see rapid growth in the future. It is expected that the penetration rate will reach 26% in 2025.

Technology status: EHB is the mainstream, EMB is the direction

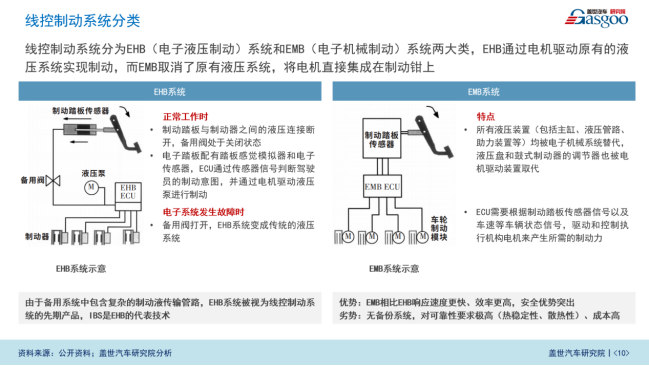

From a technical point of view, there are currently two technical routes for brake-by-wire: EHB (Electric Hydraulic Brake, hydraulic brake-by-wire) and EMB (Electric Mechanical Brake, mechanical brake-by-wire).

EHBis mainly based on the traditional hydraulic braking system, which is braked by the motor-driven hydraulic pump.

According to the degree of structural integration, EHB can be divided intotwo-box and one-box. The main difference between the two is whether the ABS/ESC system is integrated with the electronic booster.In the Two Box solution, the electronic booster and ESP/ABS are independent, the integration is relatively low, and the price is high, but it can meet the requirements of automatic driving redundancy.In the One Box solution, the electronic booster is integrated with ESP/ABS, which has the advantages of high integration, small space occupation, light weight, low cost and high energy recovery efficiency, which has become the main development trend at present.However, the complexity of this solution is high, and an RBU (Redundant Brake Unit) needs to be added to meet the redundancy requirements.

The representative products of EHB on the market now include Bosch's iBooster, Continental MKC1, ZF's IBC, Hitachi's E-ACT and other brake-by-wire products.Among them, Bosch iBooster+ESP belongs to the "Two-Box" solution.However, its latest generation IPB adopts the "One-Box" solution, and Continental MKC1 and ZF IBC are also representatives of the "One-Box" solution.In addition to international giants, since 2000, some domestic independent vehicle companies and parts suppliers have begun to develop EHB, and have achieved certain results.For example, Bethel will realize the mass production of the One-Box product WCBS in 2021. At present, the product has been delivered to the market with a number of models, and more than 20 models are expected to be mass-produced in 2022.In addition, Yingchuanghuizhi, Gelubo and other companies are also conducting research and development of One-Box products.

EMBintegrates the motor directly on the brake caliper, eliminating the need for brake fluid and hydraulic components, which greatly simplifies the structure of the brake system and facilitates layout, assembly and maintenance.Compared with EHB, EMB has many advantages, but it lacks a backup braking system and is technically difficult. It is still in the research stage. The product will be mass-produced in 2023.

Overall, the EHB system has high safety due to its backup braking system, and will still be the mainstream solution in the next 5-10 years.Although the EMB system has many advantages, it lacks a backup braking system and lacks technical support.

Competitive landscape: overseas giants dominate, and independent suppliers are catching up

From the perspective of the competitive landscape, the brake-by-wire system is currently dominated by foreign capital, with international Tier 1s such as Bosch, Continental, and ZF occupying about 96% of the market share.Most of these companies have started research and development since the end of the 1990s and have a certain first-mover advantage.

Among them, Bosch took the lead in the layout, occupying more than 60% of the global brake-by-wire market. The main products are the iBooster+ESP of the Two-Box technology route mentioned above and the IPB of the One-Box technology route. Among them, the iBooster+ESP product is launched. It has the earliest time and is currently the most widely used. IPB products are the first in China to support BYD Han; Continental MK C1 was mass-produced in 2016, mainly for the European market at the initial stage, and gradually began to face the Chinese market at the end of 2020; at present, the company has launched the second-generation product MK C2, designed for L3 or higher autonomous driving.ZF acquired the brake-by-wire technology for passenger cars and commercial vehicles through the acquisition of TRW and WABCO. At the end of 2018, its passenger car brake-by-wire product IBC began mass production, and in 2012, it launched the commercial vehicle brake-by-wire product EBS.

Relatively speaking, domestic enterprises have been involved late, and the current market share is low.However, in the past two years, with the continuous upgrading of technology, plus the advantages of stable supply chain, rapid development and market response, the trend of catching up is fierce.

A more typical enterprise such as Bethel, in 2016, started the research and development of the difficult One-Box by-wire product WCBS, and became an early mass-produced enterprise in China.In response to the increasingly escalating demand for autonomous driving, Bethel has started the development of the brake-by-wire system WCBS2.0 with brake redundancy, and has also carried out pre-research work on the electro-mechanical brake EMB.In addition, the company also has deep technical accumulation in EPB, ESC, EPS and other fields.

Yingchuang Huizhi is another potential stock in the BBW enterprise. The company was established in 2016. Its products cover key executive control components such as ESC/EPBi, T-booster, IBC, EPS, ADAS, etc., and can provide a full chain of chassis lines. control products.Among them, ESC/EPBi and T-booster can form a redundant brake-by-wire system to ensure vehicle safety.At the same time, Yingchuanghuizhi is also actively developing an integrated braking system and a redundant steering-by-wire system for L4-class and high-end passenger car applications, and it is expected to achieve mass production in 2023.At present, Yingchuanghuizhi has an annual productioncapacity. Its products and services have successfully entered SAIC-GM-Wuling, Chery Automobile, Jianghuai Automobile, Dongfeng Motor, BAIC Group, FAW Group, Changan Automobile and other domestic leading passenger car and commercial vehicle companies.

Nanjing Jingweida Automotive Technology, which has been deeply involved in the BBW field for nearly 10 years, has formed a complete series of self-developed BBW products, and has completely independent intellectual property rights including more than 130 domestic and foreign patents.In addition, a modern production line with an annual output of 300,000 sets will also be completed and put into production in July 2022. It is expected that two modern production lines will be built by the end of this year or early next year to meet the growing market demand.

In addition, Lianchuang Automotive Electronics is also a breakthrough in brake-by-wire technology.It took the company three years to break through the bottleneck of solenoid valve design and ABS/ESC core technology, and to achieve mass production of products.In addition, Lianchuang launched the IEB+RDU braking system to meet the needs of L3+ level autonomous driving.In this system, a set of RDU backup is connected in series on the pipeline of the original IEB. When the IEB fails completely, the RDU can provide a braking deceleration greater than 0.64g, which can realize simultaneous four-wheel braking.In addition, Lianchuang is currently developing a brake-by-wire solution for future intelligent driving.

In general, BBW is ushering in its market outlet, and with the development of domestic independent brands, a new market pattern will be ushered in in the future.But in addition to opportunities, challenges also exist.For example, high-end automotive-grade chips are subject to foreign countries and lack of talents.In addition, the wire control system is related to personal safety, and the technology needs to be continuously improved, which puts forward higher requirements for the technical strength of the enterprise and the cooperation of the entire industry chain.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-22 16:41:27

Hot spotsranking

Wonderfularticles

2022-06-22 16:35:34

2022-06-22 16:34:26

2022-06-22 16:21:59

Popularrecommendations