Your location:Home >Automotive News >

Time:2022-06-15 12:30:14Source:

Shanghai (Gasgoo)-Xin Guobin, vice minister of China's Ministry of Industry and Information Technology (MIIT), said on Tuesday at a press conference that a study would be made as soon as possible on whether to continue the preferential tax policy for new energy vehicle (“NEV”) purchase, which is supposed to be terminated by the end of this year.

According to China's policy, NEVs hereby refer to all-electric vehicles, plug-in hybrid electric vehicles (including range-extended electric vehicles), and fuel cell vehicles.

Wuling Hongguang MINIEV; photo credit: SGMW

To support the development of NEVs, China first began exempting NEVs from purchase tax in 2014. The policy originally expired at the end of 2017, butwas extended to the end of 2020 before it expired.

In April 2020, the government announced it would once again extend tax exemptions on NEV purchases by an additional two years to better promote the sector's development and boost auto sales.

Mr. Xin also added that the MIIT would optimize the management approach for the “NEV Dual Credit Policy”, step up the efforts to make breakthroughs in the new systems of batteries and in-car operating system, and inititate the pilot project on full vehicle electrification in public service fields.

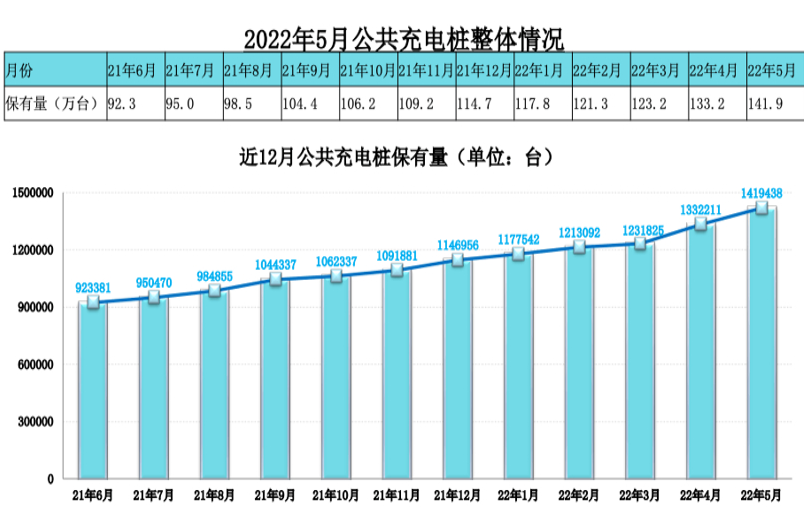

For the first five months of 2022, China's auto output and sales dropped 9.6% and 12.2% year on year to 9.618 million and 9.555 million units respectively, according to the data by the China Association of Automobile Manufacturers (CAAM). Nevertheless, the NEV sector still defied against the overall downturn with its year-to-date production and sales volumes surging 114.2% and 111.2% respectively from a year ago.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-15 12:30:14

2022-06-15 12:29:33

2022-06-15 12:28:55

Hot spotsranking

Wonderfularticles

2022-06-15 12:26:10

2022-06-15 12:24:43

2022-06-15 12:23:59

2022-06-15 12:17:33

Popularrecommendations