Your location:Home >Automotive News >

Time:2022-06-02 11:56:13Source:

On June 1, BYD responded: "It has found 6 lithium mines in Africa, and all of them have reached an acquisition intention."

Lithium is the lightest of all metal elements and is widely used in batteries, glass, nuclear industry and other industries. With the development of electricity facilities, the battery industry has also become the largest consumer of lithium.

According to reports, among the six lithium mines, the amount of ore with a grade of 2.5% lithium oxide has reached more than 25 million tons, which can be converted into 1 million tons of lithium carbonate.If the 25 million tons of ore are fully mined, it can meet the power battery needs of 27.78 million 60-degree pure electric vehicles.

Previously, BYD completely stopped the production of fuel vehicles and set the sales target of new energyvehicles in 2022at 1.5 million units. If this is calculated, winning these lithium mines will be enough to meet BYD's demand for more than ten years in the future.

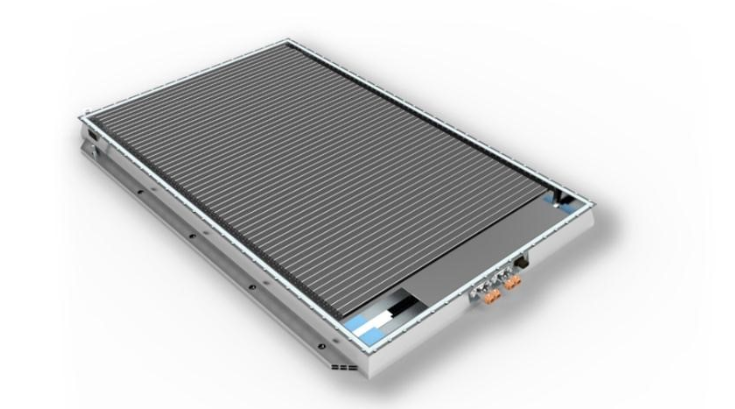

It is worth mentioning that, according to reports, several of the six lithium mines will be shipped next month, and it is expected that these lithium will be loaded into BYD blade batteries in the third quarter of this year.

In fact, BYD has already begun to deploy upstream lithium resources.In 2010, BYD took a stake in Zabuye Salt Lake, China's largest salt lake lithium mine.

In January this year, BYD won the bid for 80,000 tons of lithium in the 400,000-ton lithium tender initiated by the Chilean mining sector, but was forced to suspend it because it was stopped by the Chilean court; in March, Shengxin Lithium Energy issued an announcement to introduce BYD as a strategic investor In May, Salt Lake stated that BYD's 30,000-ton battery-grade lithium carbonate project in Salt Lake is conducting a pilot test of lithium extraction technology. If the effect of the pilot test is verified, the two parties will negotiate the start of the project.

Judging from the existing public information, it is also the first time that BYD plans to receive 1 million tons of lithium carbonate so generously. Its frequent shots may be due to the soaring price of lithium carbonate this year. This move is also expected to cool the "surge" lithium price. .

Looking back to 2021, BYD's annualcar saleswere about 740,000 units, a year-on-year increase of 73%.The operating income was 216.142 billion yuan, a year-on-year increase of 38.02%; the attributable net profit was 3.045 billion yuan, a year-on-year decrease of 28.08%; the deducted non-net profit was 1.255 billion yuan, a year-on-year decrease of 57.53%.

The increase in revenue but not profit is mainly due to rising costs, and at the same time, rising raw material prices have also led to a further drop in gross profit margins.Among them, the gross profit margin of automobiles, automobile-related products and other products was 17.39%, a year-on-year decrease of 7.81%.In the first quarter of 2022, BYD's overall gross profit margin further declined to 12.40%.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Picture and textrecommendation

2022-06-02 11:56:13

2022-06-02 11:55:28

2022-06-02 11:53:24

2022-06-02 11:52:48

2022-06-02 11:51:22

Hot spotsranking

Wonderfularticles

2022-06-02 11:50:50

2022-06-02 11:48:55

2022-06-02 11:43:54

2022-06-02 11:41:48

2022-06-01 13:19:43

Popularrecommendations