Your location:Home >Automotive News >

Time:2022-06-30 12:54:07Source:

From positioning product manager to returning to the role of investor, Zhou Hongyi has entered the new car movement in a year, from high-profile to rational, and finally chooses to let go, which is a good thing for Nezha Auto.

Weimar, Leapmotor, and Nezha are the three star car-making companies that are currently preparing for IPO in the second camp of the new car-making forces.

Among them, the sales of Nezha and Leapmotor have been on the rise in 2022, and they will occasionally occupy the top five seats. Both are regarded as dark horses in the field ofnew energy vehicletracks this year.

This year, Nezha's first electric sedan, Nezha S, will be launched soon, and it will continue to attract attention.

However, on June 26, 360's announcement of transferring part of its equity to the management of Nezha Automobile aroused the concern of the outside world on whether the relationship between 360 and Nezha Automobile continued.

01.

360 voluntarily announced the loss data of Nezha Auto

In view of the fact that Nezha Auto has not yet officially launched its IPO, 360 fully disclosed the loss of Nezha Auto in its announcement:

In 2021, Nezha Auto's revenue will be 5.735 billion yuan, with a net loss of 2.9 billion yuan, an increase of 1.58 billion yuan from the previous year's loss, and a total loss of 4.22 billion yuan in the two years.

As of December 31, 2021, Nezha Auto had total assets of 13.7 billion yuan and total liabilities of 8.3 billion yuan.

Of course, as a listed company, 360 has to announce to investors the income of its investment in Nezha Auto.

In a subsequent press release, 360 quoted analysts as saying: "360 has gained a high investment value in this round of investment. The equity transfer at par this time is part of the concerted action of the management team, which will increase the The management team's control over the company has the intention of stabilizing the corporate governance mechanism."

However, given the loss of 4.22 billion yuan, the sensitivity of this figure is in stark contrast to the continuous rise of Nezha in the sales ranking since 2022.

In fact, just like Wei Xiaoli’s first-tier brands that have already landed in the capital market, they still suffer heavy losses. The second-tier brands that focus on the economic market, Weimar, Leapmotor and Nezha, have equally astonishing losses.

The net losses of Weilai, Xiaopeng and Ideal in 2021 will be 4.02 billion yuan, 4.86 billion yuan and 670 million yuan respectively.

Leapmotor’s three-year net loss from 2019 to 2021 was 4.374 billion yuan.

WM Motor, which was originally in the first camp and later slipped to the second tier, lost 13.628 billion yuan in the past three years during the 2019-2021 reporting period.

Of these six companies, except for Ideal Auto, whose financial data continues to improve, the other five are still expanding their losses.

Unlike the halo of new car-making forces in the market, the realistic financial indicators of these startups are not likely to be profitable due to increased sales and more models.

China's new car movement has yet to enter the mid-market.

It is precisely because of this that the move of 360 to transfer 1 billion yuan of equity corresponding to an investment of 0 yuan at a price of 0 yuan has the meaning of running away and stopping losses.

Since 360 confirmed its investment in Nezha Auto last year, the current announcement shows that 360 has participated in two rounds of financing for Nezha Auto.

Among them, the B round investment of 900 million yuan was paid on May 31, 2021, and the first 1 billion yuan investment in the D1 round was paid on October 27, 2021, with a total paid-in investment of 1.9 billion yuan.

But in fact, the 1 billion yuan in the D1 round of capital increase plan has not yet been paid in.

The part of the capital increase in this transfer is exactly the 1 billion yuan that has not been paid in the original capital increase plan of 360.

In the announcement of 360, it is clearly mentioned:

The parties to the agreement have reached confirmation that after the signing of the agreement, the 1 billion yuan investment obligation that 360 should have paid to Nezha Auto in the D1 round of capital increase agreement will be performed by the transferee, that is, 360 will no longer undertake the investment obligations under the D1 round of capital increase agreement. , and shall not be liable for any breach of contract or compensation.

This has caused two doubts from the outside world, one is that 360 stops loss immediately, and the other is that 360 may face a cash flow crisis.

In this regard, 360 explained that 360 still holds 11.4266% equity of Nezha Auto after the transfer is completed.

Only in terms of the number of shares held, it has dropped to the third largest shareholder.

02.

Zhou Hongyi made it clear that the management of Nezha belongs to the management team

As for the real purpose of transferring the equity, 360 stated that it is to support Nezha Automobile's shareholding reform and other work. Handle relevant matters, sign relevant agreements and other necessary documents.

Subsequently, Zhou Hongyi, chairman and CEO of 360 Company, responded to the doubts in the market through the report of "Chinese Entrepreneur":

"Nezha Auto is still a start-up company. It needs to let the founder team lead the company's development, not capital. But now the founder team has too little equity. The positioning of 360 is to support and assist the team."

So is this really the case?

From the data that has been published, the equity distribution of Nezha Auto is indeed very loose, and the management actually does not have complete or relative control of the company's shares.

Fang Yunzhou and the management team Tongxiang Zhonghe and Shanghai Zheao Industry only hold 7.2% of the shares.

And if 360, according to its announcement, will transfer the 3.532% equity of Nezha Automobile's 79994371.67 yuan registered capital (without actual capital contribution) to Jiaxing Xinzhu Equity Investment Partnership (Limited Partnership), Shenzhen Jingcheng Open Enterprise Management Center (Limited Partnership) partnership).

But behind the two new shareholder companies are Haining Hairui Investment Management Co., Ltd. and Chengdu Red Horizon Equity Investment Fund Management Co., Ltd., and the actual controllers are Hao Qun and Wang Lisong.Judging from the public information, the two had no previous relationship with Nezha Auto and belonged to new external shareholders.

If Hao Qun, Wang Lisong and Nezha are currently acting in concert, the management team's shareholding ratio is only just over 10%.

However, according to "Chinese Entrepreneur", Zhang Yong, the co-founder and CEO of Nezha Automobile, said that the above information about shareholding is inaccurate, and the team holds more than 20% of the shares.

Although Nezha Auto's public information about the management's shareholding ratio may have a large deviation from the actual situation.

However, judging from the 3.532% equity corresponding to 1 billion yuan, it has no absolute effect on 360 or the management team.

It is more like a signal to clarify the boundary between 360 and the management team of Nezha.

The first is that 360, like the big Internet companies that have laid off workers this year, has a common problem of uncertainty about future expectations.

360's revenue has declined for three consecutive years. In 2021, it will achieve revenue of 10.89 billion, down 6.28% year-on-year. The revenue growth rates in 2019 and 2020 are -2.19% and -9.55%, respectively.

In 2018, it completed the backdoor landing on A-shares. The market value of 360 has touched the highest market value of 450 billion yuan, but as of June 27 this year, the market value was 59.235 billion, and the market value had evaporated by nearly 390 billion; the stock price was 8.29 yuan, a cumulative drop of nearly 9 from the highest point. to make.

As of March 31, 2022, the balance of cash and cash equivalents at the end of the 360 period was 4.95 billion yuan.

Zhou Hongyi's transfer of investment shares is related to 360's own economic situation, and it is also related to Zhou Hongyi's reset of 360's role in Nezha Auto.

On May 11, 2021, Zhou Hongyi bluntly stated at the 360 Group Smart Car Strategy Communication Conference that he built a car because he did not want to miss this huge opportunity for world change.

He said: "We not only invest in money, but also in people, technology and products." He also installed a new identity for himself: Nezha automotive product manager.

Zhou Hongyi, who does not know how to drive, intends to lead 360 car manufacturing with the positioning intention of the product manager is very obvious.

After that, people from 360 began to enter Nezha cars, but soon there was a public opinion turmoil of "please Wu Yifan as an endorser".

360’s entry-level car manufacturing is similar to Baidu’s. Although Baidu Apollo has cooperated with many OEMs, it has always been outside and cannot obtain core data. 360 has always hoped to replicate the PC-side 360 security guard on the smart car side, but Haven't been able to get an entry ticket.

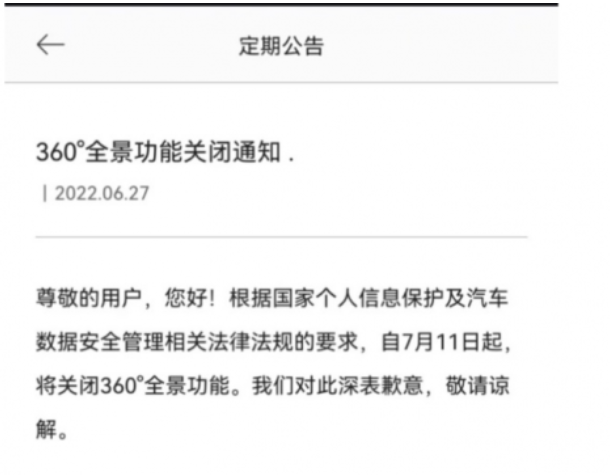

With the help of the investment in Nezha, 360 Auto Safety Guard was deployed on the new Nezha U, realizing the first "on-board" of 360 IoV security products, and taking the first step in mass production of IoV products.

At a timewhen competition fornew energy vehicles is becoming increasingly fierce, the 360 today cannot actually support a new car company independently.

03.

"150,000 yuan can't make a good car that can make money" has an answer

A crueler reality is that for electric vehiclespositioned below 150,000 yuan or around 100,000 yuan, selling one car loses one.

It would be impossible to do without government subsidies.

Given the uncertainty over the possible termination of subsidies for new energy vehicles by the end of 2022, next year is destined to be the year in which second-tier new car manufacturers will be squeezed out of the poker table.

On the other hand, as the price of power battery raw materials continues to rise in 2022, electric vehicles in this range, such as Leapmotor and Nezha, have skyrocketed in sales and suffered heavy losses on the other.

Even if it surpasses Weilai in sales and gains popularity, it will be under more pressure in terms of cash flow.

Last year, Zhou Hongyi responded to Xiaopeng Motors founder He Xiaopeng's judgment that "150,000 yuan can't make a good car that can make money": "This is like what an Internet layman would say."

For a 150,000 yuan smart electric car, it is impossible to achieve both "good" and "making money" at the same time today.

The loss data of Nezha Auto released by 360 proves that He Xiaopeng's judgment is correct.

And Zhou Hongyi accepted this reality in disguise by transferring his investment rights for 0 yuan.

This is also the only solution for electric vehicle companies in the low-end market that can only choose the high-end route.

For this reason, both Leapmotor and Nezha are launching new electric models with a price of more than 200,000 yuan.

After Nezha released the Shanhai platform, the pre-sale price of its first high-end smart electric car, Nezha S, was as high as 338,800 yuan.

It is intended to grab the market share of Weilai and Tesla.

Nezha S can be described as the life and death finance bureau of Nezha Auto.

A reverse case is that in the electric vehicle market below 100,000 yuan, the sales of the ORA brand are hot, but according to a dealer in Beijing ORA, the sales of ORA’s new models have been rising while the price of new models has been rising.

The price breakthrough is the life and death step for Euler, Nezha and Leaprun to turn cocoons into butterflies, but not every brand can cross it.

In the past year, 360 and Nezha have actually achieved each other together. 360 has gained the entrance of smart cars, and Nezha has gained attention.

Zhou Hongyi himself does not have the courage and ability of Lei Jun to break the boat and build a car, and finally retreating from financial investment itself is a wise move.

And getting rid of the high-intensity intervention of 360 is a good thing for Nezha Auto.

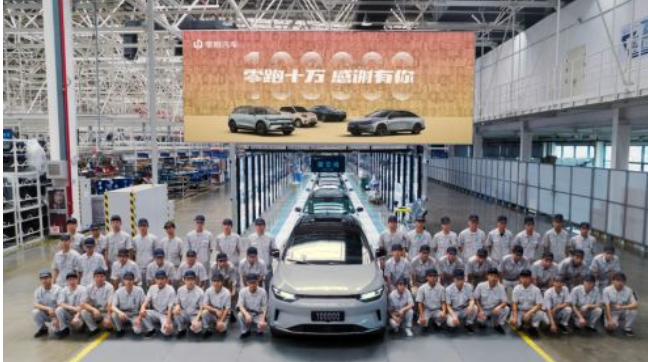

Since 2022, Nezha Auto has delivered a total of 30,152 vehicles in the first quarter, a year-on-year increase of 307%; in April, Nezha Auto once topped the list of new carmakers with terminal sales of 9,004 vehicles; in May, Nezha Auto delivered 11,009 vehicles, A year-on-year increase of 144% and a month-on-month increase of 24.9%.

These data are quite eye-catching in the capital market.

On June 22, Zhang Yong, CEO of Nezha Automobile, said in a circle of friends:

"1. Regarding supply chaincapacity, we are doing the hard work of climbing, and if it goes well, delivery will exceed 200,000 units in 2022.

2. Expectations for Nezha S: A monthly sales of over 10,000 units is a pass line, and a monthly sales of over 20,000 units is considered a top student."

For Nezha, Leapmotor and Weimar, which are planning IPOs, sales are the core data to support their valuation and complete financing.

For Nezha, with a consideration of 1 billion yuan for a 3.532% stake, the current total valuation of Nezha Auto has reached 28.3 billion yuan.

It is reported that Ne Zha has opened a Pre-IPO round of financing with a target valuation of about 45 billion yuan, and plans to go to Hong Kong for an IPO within this year.

It seems that Nezha S's expectations are far higher than the outside world imagines.

Zhou Hongyi and Nezha Auto ended up with an investment of 1.9 billion yuan, which is not a bad thing for Nezha Auto. For entrepreneurs who are dedicated to building cars, they should keep a certain distance from those Internet strongmen who are not involved in the game but have a strong desire for control. In fact, they achieve each other.

Compared with the hatchback, looking at Lei Jun from another angle, the courage is indeed commendable.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-30 12:52:38

2022-06-29 16:51:43

2022-06-29 16:51:18

Hot spotsranking

Wonderfularticles

2022-06-29 16:43:12

2022-06-29 16:42:26

2022-06-29 16:41:36

2022-06-29 16:33:42

Popularrecommendations