Your location:Home >Automotive News >

Time:2022-06-07 11:22:16Source:

Since May, auto stocks have continued to rebound, and the sector has risen by 35.13%. The haze of "continuous declines" since the beginning of the year has been swept away.

However, the auto market has not yet fully recovered. Since the beginning of the year, the market value of all companies except BYD has been in a state of decline.

When the battle to save the market from the central to the local level has begun, under the bombardment of good news, can the stock market regain its long-lost "vigor"?

How big is the coverage?

On May 31, the 60 billion purchase tax subsidy was implemented, and the vehicle purchase tax was halved for passenger cars with a displacement of 2.0 liters and below that did not exceed 300,000 yuan.

Chen Shihua, deputy secretary-general of the China Association of Automobile Manufacturers, said that the policy of halving the purchase tax is expected to drive the increase in the auto market by more than 2 million vehicles this year, and the consumption volume will exceed 300 billion yuan.

In addition, more than 8 provinces, cities and regions in China have recently introduced relevant measures to promote automobile consumption, which are rare in the past few years.

Chen Shihua pointed out that in 2021, the sales volume of 1.6L displacement (inclusive)-2.0L displacement models will account for 96.8%.If including the pull on the upstream and downstream industrial chains, the overall pull of these policies on automobile consumption in 2022 will exceed 500 billion yuan.

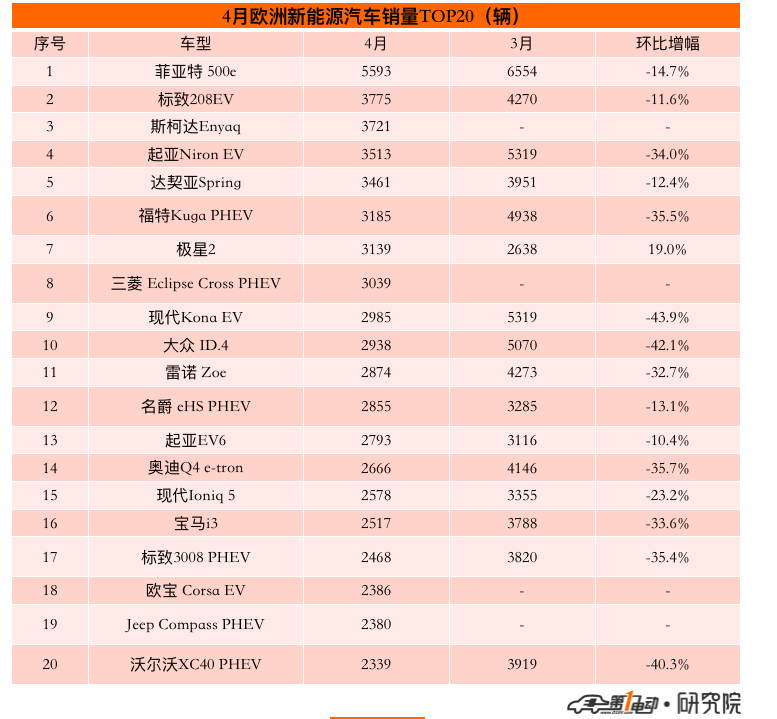

At the same time,new energyvehicles also ushered in good.

On May 27, the Ministry of Industry and Information Technology held a teleconference on boosting the industrial economy, mentioning the organization of a new round ofnew energy vehiclesto go to the countryside.In this regard, many governments have also actively followed up, with different measures to encourage new energy to go to the countryside.

In terms of industrial chain, on May 29, Shanghai also released the "Shanghai Action Plan for Accelerating Economic Recovery and Revitalization", and the content of promoting automobile consumption has become the focus of the industry.At present, many car companies and dealers are actively preparing to resume work and production, and formulate preferential measures in response to favorable policies in the car market.

Signs of recovery are also reflected in the significant rise in the manufacturing PMI.The latest data from the National Bureau of Statistics showed that in May, the manufacturing purchasing managers' index (PMI) was 49.6 percent, up 2.2 percent from the previous month.The composite PMI output index was 48.4%, up 5.7% from the previous month.

The supply chain crisis is also on the rise.According to the monthly analysis released by the Federation of Passenger Transport Associations, the shortage of chips will be greatly eased in the third quarter, and the wholesale market will show a strong upward trend in August.

The agency said that there are 22 working days out of 31 natural days in July this year. In addition, some car companies have more vacations due to factors such as shortage of chips in the early stage. From July to August, there will be more abundant production capacity, and automobile production may welcome to grow.

Projected to the capital market, A-shares are rising, Hong Kong stocks are maintaining stability, and US stocks are under pressure.One side is sea water, the other side is fire.

Great Wall Motor: Back to 300 billion

In May, the most prosperous auto stock in A-shares is probably Great Wall Motors.

Within a month, Great Wall had the daily limit for several consecutive days, with an increase of more than 50% at one point, the stock price rebounded by more than 60% from the low level, and the market value rushed back to the 300 billion mark.

At the same time, in the product matrix of Great Wall, more than 80% of the models are 2.0-liter fuel vehicles.Therefore, the 60 billion subsidy will bring huge benefits.At the same time, pickup brands will also benefit from policies such as car going to the countryside.

Some analysts pointed out that sales are expected to have a significant pulling effect, and they are optimistic about the overall recovery and development of the automotive sector.This policy will obviously benefit car companies with high sales flexibility and good profit margins

In addition, there are market rumors that Great Wall Motors may acquire the Longyan plant of Fujian New Longma Motors.At the same time, the Great Wall in the field of hydrogen energy has also attracted the attention of many investment institutions.

It is reported that Great Wall Motor's fuel cell passenger vehicle brand and products are ready internally and are expected to be launched by the end of 2022.At present, Great Wall Motors has completed the product planning for fuel cell passenger vehicles, and plans to launch it as an independent brand, positioning it as a high-end vehicle.

In 2022, Great Wall will also enter a new round of model launch cycle. In 2022, it will launch new models such as Wei Brand Dream, Haval Kugou, Ora Lightning Cat, Ora Punk Cat, Tank 700, and Salon Mecha Dragon, which are expected to receive new models. Track increments.

CITIC Securities believes that the supply of chips in the industry continues to improve in the second half of the year, and Great Wall's sales are expected to be released.Another person from the securities department of Great Wall Motor further stated: "Since 2022, due to various factors, our sales have been limited, and we are gradually maintaining the stability of the supply chain through various methods such as the development of secondary supply. In the second quarter Sales will definitely pick up significantly.”

Changan Automobile: Bullish all the way?

Also rising, there is Changan Automobile.

The recovery of performance is one of the main reasons why Changan is favored by capital.

In the first quarterly report of 2022, Changan Automobile achieved a net profi t of 4.536 billion yuan, a year-on-year increase of 431.45%. The net profit for a quarter even exceeded the net profit of Changan Automobile in 2021.

On May 30, Changan officially unveiled to the public another new energy brand, the SL03, the first model of Deep Blue.The new car is built on Changan’s new EPA1 pure electric platform, offering three power modes: pure electric, extended-range version and hydrogen electric version. It is China’s first mass-produced hydrogen fuel cell car.

The layout of the multi-technological route partly shows Changan's preparation and determination for the transformation of new energy.Judging from the overall sales volume, at present, Changan is still in the stage of recovery of joint venture brands, upward promotion of its own brand fuel vehicles, and layout of new energy brands.

At the same time, Avita, a smart electric vehicle brand jointly created by Changan, CATL and Huawei, completed a new round of valuation updates in May, increasing from 780 million yuan to 6.26 billion yuan, an increase of more than seven times within six months.This is also one of the boosting forces for Changan's net profit growth.

In the capital market where policies have begun to tighten, Avita, which has not yet started delivery, obtained this valuation, which shows that the market has sufficient confidence in it.But whether the second quarter can continue the previous profit margin remains to be verified.

It can also be seen from the popularity of Avita that although Huawei has repeatedly stated that it does not build cars, the presence of Huawei in the car rim cannot be ignored.

Xiaokang shares: high-speed callback

In May alone, Xiaokang shares rose more than 35%.With the Huawei platform, the sales finally "go" once.

The most eye-catching is the Wenjie M5, which has attracted much attention since its launch, and its sales have gradually climbed.Official news shows that 11,300 vehicles were delivered in 87 days.

Since its launch, in March 2022, in the mid-to-high-end electric SUV market of more than 200,000 yuan, Wenjie M5 has sold 5th in the industry with 3,045 units, ranking behind Model Y, Ideal ONE, BYD Tang, and Weilai ES6.In April, its sales ranked third in this segment, with monthly sales of 3,245 units.

At the same time, Wenjie is already accumulating the next model.

Yu Chengdong revealed that the Wenjie M7 will be released at the end of June and is expected to be delivered at the end of July.As the second model of AITO, Wenjie M7 is positioned as a large luxury SUV.The exterior dimensions are compact and the interior space is large.

He also said that the M7 will "allow leaders to rest very comfortably" as an important selling point, "to outperform all luxury cars, high-end cars and MPVsincluding Toyota Alfa, Lexus LM ".

"Bring everyone a comfortable and intelligent experience that surpasses million-dollar luxury cars."

He revealed that the Wenjie M5 will also have a pure electric version, which is expected to be launched in the third quarter of this year, so that consumers can experience the Wenjie M5 in October.

BAIC Blue Valley: Extreme Fox is very busy

Compared with the good AITO brand, Jihu is obviously more questioned.

In May, there was a lot of new news from BAIC Blue Valley.Busy releasing the Extreme Fox Alpha SHi version, and also busy holding a concert on the video account.

On May 29, Jihu Automobile announced the results of its sponsored Luo Dayou video concert.More than 41.61 million views, and the total exposure on the entire network exceeds 2.77 billion.

73 days ago, Jihu Automobile sponsored Cui Jian's concert, and the results were equally impressive, with a cumulative audience of over 40 million.

The traffic is considerable. On May 24, when Luo Dayou's concert announced that it was named by Jihu Automobile, the "Jihu" WeChat index reached a peak of 7.22 million.On the day of the concert on the 27th, the WeChat index of "Jihu" was close to 5 million, and the popularity continued for several days.

Such a high-profile communication strategy has also received a good response in the capital market.In May, BAIC Blue Valley rose by more than 16%, sweeping away the previous decline.

An insider of Jihu Automobile told the media that Cui Jian’s concert had an exposure of 1.6 billion on the whole network, and the high-intent car purchase information brought about it exceeded 1,000, and the expected conversion rate was over 90%.The sales leads brought by Luo Dayou's concert will be announced later.

However, some doubters believe that although the concert is popular, the brand of Jihu is not loud enough.

An investor said to BAIC Blue Valley: "For online concerts, the company should insert some Jihu test drive videos, or the parameters of Jihu models. Offline, my family and friends don't know Jihu, and it will be a straight line to increase the interactive effect. rise."

After all, these "heats" are all in exchange for the investment of real money.In the first quarter of 2022, the sales expenses of BAIC Blue Valley continued to increase, with sales expenses of about 310 million, a year-on-year increase of 63%.

For Jihu, the key at present is whether traffic can be converted into performance.Investors are still waiting for the answer from BAIC Blue Valley.

BYD: Upward shock

Since May 10, BYD's share price has topped 300 yuan.The overall increase in May was 21.77%, and the latest market value was 877.4 billion yuan.

Under the pressure of the industry, BYD's advantages in sales and supply chain are even more evident.

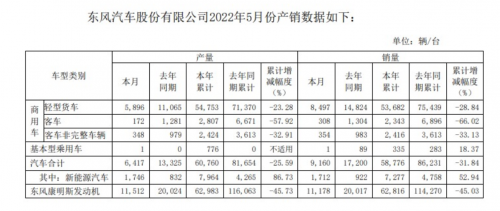

Affected by the epidemic and price increases, sales of many new energy vehicle companies declined in April, but BYD's sales remained high.Data show that BYD sold 106,000 new energy vehicles in April, an increase of 1.11% month-on-month and a year-on-year increase of 313%.

At the same time, BYD also reported good news in the battery raw material supply chain.

According to surging news reports, BYD has found six lithium mines in Africa, and all of them have reached acquisition intentions.

According to BYD's internal calculations, among the six lithium mines, the amount of ore with a grade of 2.5% lithium oxide has reached more than 25 million tons, which can be converted into 1 million tons of lithium carbonate.The above-mentioned source also revealed, "In terms of cost, the loading price of lithium carbonate per ton is definitely below 200,000 yuan."

Soochow Securities Research Report shows that if all the above-mentioned minerals are mined, it can meet the power battery needs of 27.78 million 60-degree pure electric vehicles.

BYD's sales target in 2022 is 1.5 million vehicles. Based on this calculation, the lithium ore it has won will meet its battery needs for more than ten years.

As BYD's own supply chain's scale cost and technological iterative advantages continue to grow in competitiveness, it is expected to bring a new growth curve to the brand in multiple links of the supply chain in the future, occupying the market position of the vertical track.

Tesla: Thrilling

The world's "steepest" roller coaster, located in Fuji-Q Highland, Japan.This 1,000-meter-long track has a 121-degree vertical landing at the steepest point and a speed of up to 100 kilometers per hour.

If anyone's thrill level can beat it, there is no doubt that it is Tesla's stock price.

In just over a month, Tesla’s stock price plummeted from $1,145 in early April to $758 in late May, a drop of nearly 34%.The lowest point dropped to around $620, close to halving.

Tesla short sellers have made $8.2 billion this year as tech stocks tumble, according to the latest data from data provider Ortex.

Tesla is under pressure from multiple sources under the negative influence ofproductionlosses, regulatory scrutiny and a sharp drop in its stock price.Meanwhile, Musk's possible role as Twitter's interim CEO and his involvement in thorny political and social issues has also left analysts worried about Tesla's future financial performance.

Tesla is expected to produce 1.2 million vehicles for the year, down from 1.4 million previously.Moreover, the negative impact of Musk's proposed acquisition of Twitter has potential risks, both for Tesla's management and its stock price.

At the same time, as a new force in the Chinese stock market, the valuation is still in a state of collective halving.

According to data from SPDB International Securities, the current price-sales ratios of Weilai, Xiaopeng and Ideal are 2.2x, 2.4x and 2.6x, down 25%, 21% and 9% from March, and their valuations have changed from "high" Back to health.

At the same time, panic has exacerbated the decline in stock prices.

On May 5, the US Securities and Exchange Commission (SEC) has included a number of Chinese concept stocks including Weilai Automobile, Ideal Automobile, and Xiaopeng Automobile on the "pre-delisting" list, so it is not ruled out that Weilai's listing in many places is in Prepare for the U.S. delisting in advance.

When the U.S. stock valuation dividend period has passed, the new forces will inevitably improve their self-hematopoietic ability.The recently frequently reported business adjustments and optimizations may be part of "self-help".

For Pinguan Xiaopeng, supply guarantee is the most important thing at present.

Xiaopeng Motors: the pain of top sales

Since ancient times, any commodity that has the potential to be "hyped" will quickly become popular in the secondary market.For example, KFC's latest packaged toy, the Duck, has risen from 79 yuan to 1,300 yuan per piece.

It's a little harder to grab chips than grab a children's package.For example, He Xiaopeng, who grabbed the Duck, had to ask for a chip on Weibo.

Recently, at the Guangdong-Hong Kong-Macao Greater Bay Area Auto Show Forum, Xiaopeng Motors made inquiries about some chips to some surrounding suppliers. Xiaopeng provided the specifications of three chips for inquiries. The prices of the chips are 3,000 yuan, 2,700 yuan and 2,500 yuan respectively.

But the purchase price of these three chips should be less than 10 yuan.

Through this story, He Xiaopeng is also revealing to everyone that the current chip is not optimistic.

"For a long time to come, the shortage of chips will still be a major constraint on car deliveries," he said.

This is also one of the dilemmas of Xiaopeng's growth.Since the third quarter of last year, Xiaopeng has gradually opened the gap with the other two in terms of delivery volume, and has won the "top sales".But at the same time, Xiaopeng is also the one with the smallest revenue among the "three fools".

Reflected in the stock price in May, Xiaopeng fell by a total of 4.51%, and has fallen by more than 55% since the beginning of the year.

How to maintain the sales advantage and continue to make up for the shortcomings will be left to Xiaopeng to solve the problem.

Wei Lai: "Rolling King" was born

The involutionary war of the new car-making forces is still escalating infinitely.In the past, a series of operations of "roll" sales, "roll" research and development, and "roll" radar could no longer be satisfied.

Now, Weilai Automobile has begun to "roll" the market, and "roll" has gone to sea.

On May 20, NIO was officially listed on the Singapore Exchange with the stock code NIO, making NIO the world's first Chinese company to be listed in New York, Hong Kong and Singapore at the same time.

Different from the IPO listing, NIO’s listing this time is an introduction and does not involve new share issuance and fund raising. The company’s Class A shares listed on the SGX can be fully converted to its American depositary shares listed on the New York Stock Exchange.

After a fierce operation, Weilai's US stock price rebounded 4.13%, but it still fell 47.4% compared with the beginning of the year, and it is in a state of close to half.

At the same time, Weilai began to "do things" in the United States.According to rumors, the recruitment positions include overseas manufacturing park planning experts, body craft experts (overseas projects), overseas planning and infrastructure experts, overseas logistics project managers, etc.

Some analysts pointed out that Weilai intends to build a factory in the United States, and will adopt the form of CKD (full assembly) / SKD (semi assembly) in the early stage.He also said that at the beginning of this year, Weilai doubled the office space for the US team.

But Deutsche Bank analyst Edison Yu also believes that it may take several years for NIO to enter the U.S. market, and it is unlikely to be realized before 2025.

Ideal car: Q2 under pressure

In 2022, the ideal is still the new force that is most able to "make money".

It is ideal to hand over the first quarter financial report. In May, the stock price rose by 11.77% as a whole, and the stock price fell by 24% compared with the beginning of the year.

Despite the pressure on sales, Lixiang Motors did not lose much.In Q1 2022, the delivery volume was 31,716 units, and the sales volume fell by 9.9% month-on-month, which was the main reason for the turn from profit to loss in this quarter.

According to the financial report, Ideal’s net loss in the first quarter of 2022 was RMB 11 million, compared with a net loss of RMB 36 million in the same period last year.On the whole, losses are narrowing.

The performance is also reflected in the stock price. Ideal rose nearly 12% in May, which is also the highest among the three new forces.

However, due to the rebound of the epidemic, the supply chain, logistics and production of the entire automobile industry have experienced severe shocks.In April, Lili delivered a total of 4,167 Lili ONEs, almost half of the 110.34 million units delivered in March.

The main reason is that the ideal manufacturing base is located in Changzhou, Jiangsu, in the center of the Yangtze River Delta.At the same time, more than 80% of its parts suppliers are located in the Yangtze River Delta region, and a large part of them are located in Shanghai and Kunshan, Jiangsu, which is one of the areas most affected by the epidemic.

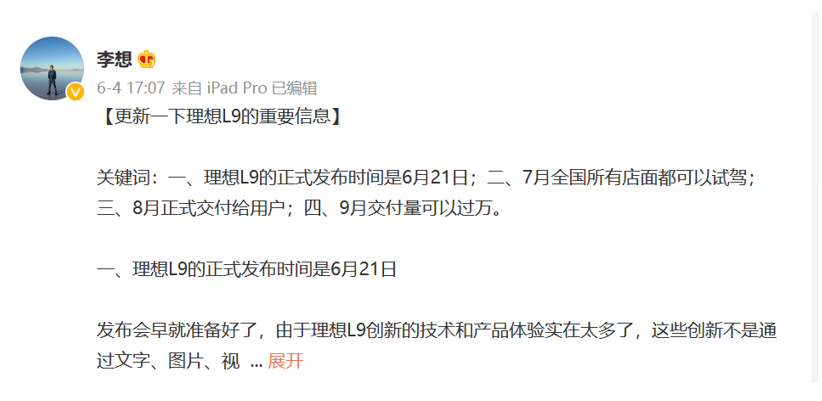

Previously, the Ideal L9 was originally planned to debut at the Beijing Auto Show in April this year, but due to the postponement of the Beijing Auto Show, the exact debut time of the Ideal L9 has also become unknown.

In the case of delayed release of new cars, the ideal of "one bike to conquer the world" is also facing greater pressure.From this point of view, the ideal Q2 decline is almost a foregone conclusion.

Conclusion: Confidence is more important than gold

Overall, the market is gradually regaining confidence.

In the past, due to concerns about the uncertain policy environment, increasing downward pressure on the economy, and the risk of pre-delisting in overseas markets, Chinese concept stocks generally encountered excessive selling in the early stage, and their stock prices experienced a sharp correction.After such an irrational adjustment, the strong financial reports of the above companies have sent a positive signal, which has attracted the attention of the bottom-hunting funds.

Previously, many mainstream foreign institutions have expressed their continued optimism on the long-term investment value of the Chinese market.

Jump out of the capital logic circle and focus on my country's manufacturing industry.It can also be seen that the industry is on the road to recovery, but the road is still long and difficult.

In terms of sub-indices, the five sub-indices that make up the manufacturing PMI are all below the critical point.

The production index was 49.7%, an increase of 5.3% from the previous month, indicating that the prosperity level of manufacturing production has improved.

The new orders index was 48.2%, up 5.6% from the previous month, indicating that the manufacturing market demand is recovering.

The raw material inventory index was 47.9%, an increase of 1.4% from the previous month, indicating that the decline in the inventory of major raw materials in the manufacturing industry narrowed.

The employment index was 47.6%, an increase of 0.4% from the previous month, indicating that the employment prosperity level of manufacturing enterprises rebounded slightly.

The supplier delivery time index was 44.1%, up 6.9% from the previous month, and still below the critical point, indicating that the delivery time of manufacturing raw material suppliers is still slow.

According to the China Automobile Dealers Association's China Automobile Dealer Inventory Warning Index Survey, in May 2022, the inventory warning index of China's automobile dealers was 56.8%, a year-on-year increase of 3.9% and a month-on-month decrease of 9.6%. The inventory warning index was above the line of prosperity and decline.

The auto market in May improved compared to April, with auto production and transportation gradually recovering, but it will take some time for auto consumption to fully recover, and the auto circulation industry is still in a recession.

On the whole, enterprises are on the way to gradually resume work, and thecapacityutilization rate has been further improved.However, the logistics and supply chain are still full of challenges.

Statement: the article only represents the views of the original author and does not represent the position of this website; If there is infringement or violation, you can directly feed back to this website, and we will modify or delete it.

Preferredproduct

Picture and textrecommendation

2022-06-07 11:21:16

2022-06-07 11:20:12

2022-06-07 11:19:32

Hot spotsranking

Wonderfularticles

2022-06-07 11:16:44

Popularrecommendations